Indicators on chapter 13 bankruptcy You Should Know

When you comprehensive The category, you’ll receive a certification of debtor training. In Chapter 7, you will be needed to accomplish The category in just sixty days on the date set to the Assembly of creditors. In Chapter 13, you should total the class right before filing a movement requesting a discharge of debts.

I specially take pleasure in the interplay involving different follow locations, and also have served clients with equally marital or divorce challenges and fiscal complications for instance...

In this article, we’ll discover the relationship amongst bankruptcy and insurance, and what this means for you. We’ll talk about the different sorts of bankruptcy, the results on your individual funds, And the way it could effect a variety of insurance procedures for example dwelling insurance, vehicle insurance, and well being insurance.

People today can file bankruptcy without the need of an attorney, which is called filing Professional se. Having said that, trying to find the advice of a qualified attorney is strongly proposed due to the fact bankruptcy has lengthy-expression financial and legal outcomes.

That means that you could turn out saving dollars on an insurance policy just after bankruptcy Significantly more rapidly than you'll ordinarily.

Chapter seven Bankruptcy: Also called liquidation bankruptcy, this sort involves selling the debtor’s non-exempt assets to repay creditors. It will likely be available to men and women and corporations with limited property and cash flow.

The trustee can’t liquidate payments that aren’t aspect within your estate, which means you don’t need to checklist them site link in your bankruptcy kinds. You also don’t have to worry about boasting them as exempt.

Bankruptcy is usually a daunting and complicated subject, but being familiar with its implications can help you make informed selections about your individual funds.

Asset is simply One more term for home. Any property you personal, such as these details property rights, counts being an asset. All of the residence you very own when you file bankruptcy is referred to as your bankruptcy estate. Your bankruptcy trustee oversees your bankruptcy estate. Among other obligations, they Be certain that:

We might get the process begun promptly by filing electronically. In most cases, index you will be secured by the automated remain the moment you file, and the threat of lawsuits, wage garnishments, and utility shutoffs stops straight away.

Its unfavorable score impression lessens as time passes, but when insurance carriers within your condition make use of your credit rating-dependent insurance scores that will help set fees, bankruptcy could lower your rating and trigger greater premiums.

Bankruptcy could indirectly affect your vehicle insurance costs because it is recorded with your credit rating reports. Auto insurance organizations Really don't Examine credit rating experiences, but numerous use specialized important link credit score-dependent insurance scores derived from credit studies to help you set your prices.

Chapter 11 bankruptcy will not be just for firms. There are various individuals with adequate individual belongings to demand a strategy that can cope with their one of a kind problems.

In conclusion, bankruptcy and insurance are intertwined areas of economic administration that require consideration and thorough thought. By understanding how bankruptcy could effects your insurance and proactively click reference running your coverage, you are able to defend your pursuits, property, and monetary nicely-currently being through the bankruptcy process and past. Constantly request Experienced steerage to navigate these sophisticated matters effectively.

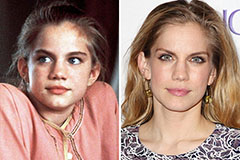

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Michael C. Maronna Then & Now!

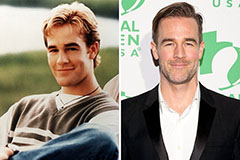

Michael C. Maronna Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!